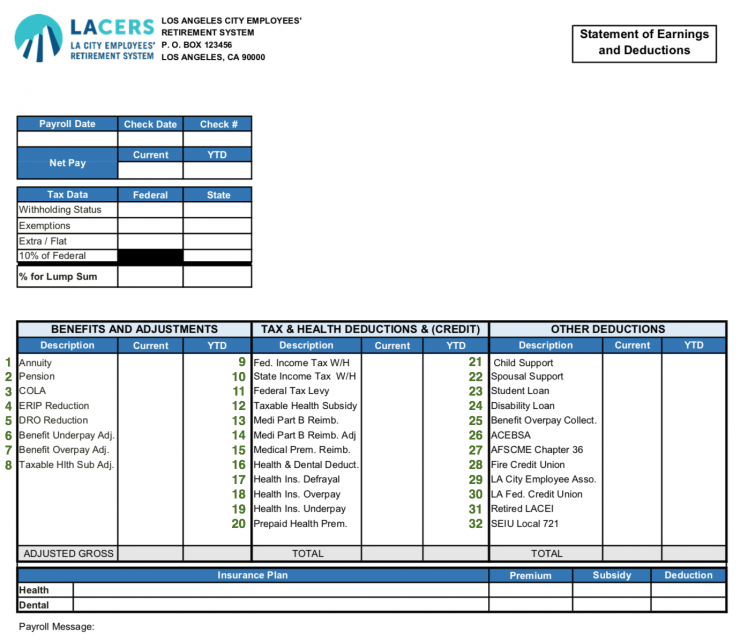

In order to help you better understand the different codes

on your LACERS retirement benefit paystubs, we have provided

the following explanation of terms for your

reference:

*Please refer to the sample paystub shown here, which

contains numbered entries that correspond to the terms

listed below.

1. Annuity

The portion of a Member’s monthly retirement benefit payment that

is paid from their own retirement contributions and interest made

during employment. This is calculated in accordance with the

retirement benefit formula.

2. Pension

The portion of a Member’s monthly retirement benefit payment that

comes from City contributions. It is the remaining balance that

is payable to the retiree on account of his or her service that

is not covered by the contributions and interest on deposit at

LACERS.

3. COLA

A cost-of-living adjustment determined annually by LACERS’ Board

of Administration which increases a Member’s monthly retirement

allowance. For more information on COLAs, please

visit https://www.lacers.org/cost-living-adjustments-cola.

4. ERIP Reduction

The required 1% that employees pay to cover the cost of the ERIP,

as referenced in the LACAC Section 4.1033.

5. DRO Reduction

A reduction applied to a Member’s monthly retirement allowance

due to a Domestic Relations Order from the court.

6. Benefit Underpay Adj.

A one-time credit to a Member’s monthly retirement allowance.

Contact LACERS for details.

7. Benefit Overpay Adj.

A one-time debit to a Member’s monthly retirement allowance.

Contact LACERS for details.

8. Taxable Hlth Sub Adj.

A one-time adjustment. The portion of your medical subsidy used

to provide Health Insurance Coverage to non-tax dependents.

A non-tax dependent is someone you cannot claim on your

federal income tax return.

9. Fed. Income Tax W/H

A deduction that goes toward Federal Income tax. For more

information on Federal taxes, please visit https://www.lacers.org/update-your-tax-withholding-elections.

10. State Income Tax W/H

A deduction that goes toward State Income tax. For more

information on state taxes, please visit https://www.lacers.org/update-your-tax-withholding-elections.

11. Federal Tax Levy

A levy authorized and assessed by the Internal Revenue Code (IRC)

to collect delinquent tax.

12. Taxable Health Subsidy

The taxable portion of a Member’s medical subsidy used to provide

Health Insurance Coverage to non-tax dependents. A non-tax

dependent is someone you cannot claim on your federal

income tax return.

13. Medi Part B Reimb.

A reimbursement paid to a Member for their Medicare Part B basic

premium payment. For more information on Medicare, please

visit https://www.lacers.org/medicare.

14. Medi Part B Reimb. Adj

A deduction made for overpayment of previous Medicare Part B

reimbursements.

15. Medical Prem. Reimb.

A quarterly credit for participants in the Medical Premium

Reimbursement Program (MPRP). For more information on MPRP,

please visit https://www.lacers.org/medical-premium-reimbursement-program-mprp.

16. Health & Dental Deduct.

A deduction that pays the portion of your health insurance

premium and dental insurance premium not covered by your health

subsidy.

17. Health Ins. Defrayal

A refund for Anthem Blue Cross medical plan enrollees when there

are accumulated excess premium dollars after claims have been

paid.

18. Health Ins. Overpay

Repayment of Health Insurance Coverage premiums previously paid

or Medicare non-compliant premiums previously charged.

19. Health Ins. Underpay

A deduction to collect money due to LACERS for Health Insurance

Coverage. Contact LACERS for details.

20. Prepaid Health Prem.

A deduction from a prepaid balance made by the Member to

cover the remaining amount of health plan premium costs when

the health subsidy and monthly allowance are not sufficient to

cover the full cost.

21. Child Support

A required deduction to pay for an active child support court

order.

22. Spousal Support

A deduction to pay for a spousal court order.

23. Student Loan

A deduction to pay an existing student loan.

24. Disability Loan

A deduction to pay an outstanding disability loan.

25. Benefit Overpay Collect.

A deduction from a Member’s paycheck to adjust for a larger

benefit amount paid previously.

Modifying and/or Stopping Member Elected

Deductions

Please contact the organizations listed below directly to

modify and/or stop deductions from your monthly retirement

allowance.

26. All City Employees Benefits Service Association (ACEBSA)

https://www.acebsa.org

27. American Federation of State, County and Municipal Employees

(AFSCME Chapter 36)

https://www.afscme36.org/

28. Firefighter’s First Credit Union

https://www.firefightersfirstcu.org/

29. LA City Employee Association

https://www.employeesclub.com

30. Los Angeles Federal Credit Union

https://www.lafcu.org/

31. Retired Los Angeles City Employees Inc.

https://www.rlacei.org/

32. Service Employees International Union (SEIU Local 721)

https://www.seiu721.org/