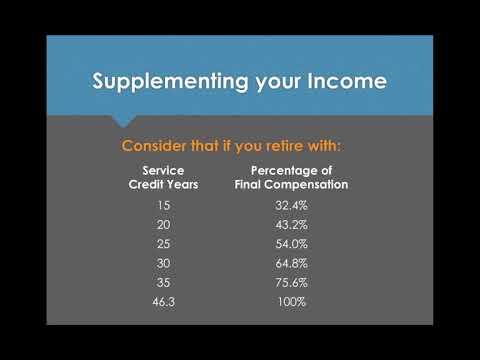

Supplementing Your Retirement

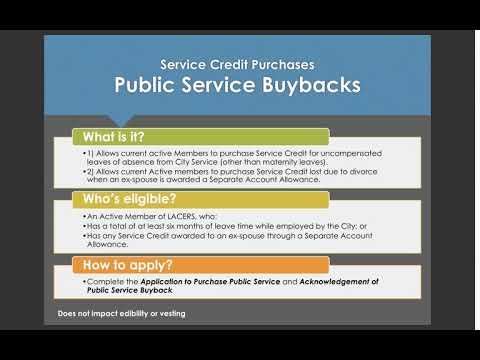

Service Credit Purchases

If you are eligible to purchase Service Credit, doing so may count toward your retirement eligibility and may increase your retirement allowance and health subsidy. Please note that the processing time for service credit purchase applications is 4 to 11 months (see timeline here). LACERS offers the following Service Purchase options:

- Back Contribution Information Sheet

- Back Contribution Information Sheet for Participants of the Pension Savings Plan

- Tier 1

- Tier 3

- Public Service Buyback Information Sheet

- Re-deposit Information Sheet

- Application to Purchase Public Service

- Certification of Service

- Certification of Uncompensated Maternity Leave

- Application to Purchase Previous City Service

- Certification for Hiring Hall Service Purchase

- Hiring Hall Service Credit Purchase Information Sheet

- Read more

Reciprocity

Reciprocity is an agreement among certain California public

retirement systems allowing members to move from one public

employer to another. The move must be made within six months of

leaving one agency to another participating reciprocal agency.

This allows for some portability of retirement

benefits.

When you retire, you will receive a retirement benefit based on

your years of service and benefit formula from each reciprocal

agency.

Larger Annuity Program

The Larger Annuity Program (LAP) is an optional retirement investment account administered by LACERS that allows you to invest post-tax funds toward your retirement. You can start with as little a five dollars a pay period or provide a lump sum payment and you may terminate participation at any time.

At the time of retirement, you can either withdraw the funds and interest from the LAP or convert them into a monthly benefit to supplement your retirement allowance. A three percent increase will be applied for every full year.

There are two options for investment that you may select from:

- Larger Annuity - Initiation or Change of Contribution Amount

- Larger Annuity - Distribution Election Form

- Larger Annuity - Election to Change Investment Option or Terminate Bi-Weekly Contributions

- Tax Notification

- Trustee-to-Trustee Transfer/Direct Rollover Form For Larger Annuity

- Larger Annuity Fact Sheet

- Read more